Linda Tait shares her thoughts on retirement

Senior mortgage lender Linda Tait will retire from North Shore Bank at the beginning of April, after over 20 years here. She shared a few thoughts with Shorelines about leaving.

Senior mortgage lender Linda Tait will retire from North Shore Bank at the beginning of April, after over 20 years here. She shared a few thoughts with Shorelines about leaving.

“My favorite movie of all time is It’s a Wonderful Life — I know that what we do makes a difference,” she writes. “Throughout my employment, I have been fortunate enough to work in an environment that supports this premise. I honestly can’t think of another industry I would have enjoyed this much. I have always felt gratified to assist our customers and make their home ownership dreams a reality.” See what else Linda had to say and congratulate her in the comments!

Staeven donates prize to help coronavirus relief

Brett, a winner with a winning smile.

Here’s some inspiring news from North Shore Bank: When our annual Mortgage Days event wrapped up at the end of February, Allouez assistant branch manager Brett Staeven had made the most qualified referrals during the promotion and won himself a prize — his choice of either a Chromebook computer or a flat-screen television. But instead of taking one of those electronic devices, Brett asked the bank to donate the money that would have been spent on the prize to Project C.U.R.E., a humanitarian relief organization working on a cure for the COVID-19 virus.

“Honestly, I didn’t need a TV and thought this would be more useful,” Brett said. “I really appreciate that Chris Boland and the bank made it work.”

As for his Mortgage Days success, Brett credits his colleagues with helping make it possible. “Mickey Adams is the best manager I’ve ever had, and getting to work with her has helped put me in a position to be successful,” he said. “I’ve always appreciated working closer with Chris than most branch employees, which has helped broaden my mortgage knowledge. Sherry Leanna, our mortgage officer, has also been very beneficial over the last couple years and is always helpful whenever I have questions. Universal bankers Aubrey Abrahamson and Laurie Kocken at the branch also helped with their conversations at the teller line. Wouldn’t have been possible without all of them, so I appreciate it!”

The bank will double the $300 from Brett’s prize for a total $600 donation to Project C.U.R.E.

“This was our most successful Mortgage Days to date, and Brett did an exceptional job helping our customers with their options during mortgage days,” Chris said. “I commend him for his generosity and thoughtfulness during this unique time in history; real-life heroes put others before themselves. Way to go, Brett!” •••

McHenry highlights changes made due to virus

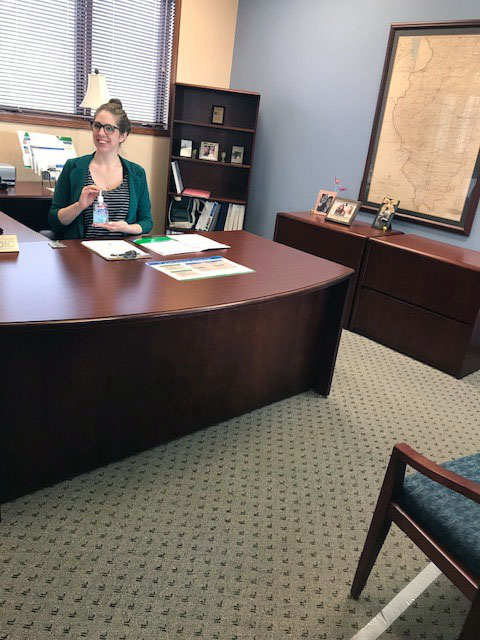

Dawn shows off the new seating arrangement at her desk at McHenry, from a safe distance.

The COVID-19 pandemic has certainly changed how our branches operate! McHenry teller supervisor Dawn Conley shared photos and information highlighting some of the adjustments made to keep our customers and employees safe.

See the bank’s guidelines on safety policies and procedures during the coronavirus outbreak.

“We have locked our front doors, allowing customers in only if they’ve called ahead or if they make some kind of hand signal indicating they must come in,” she reports. “We either go to the door and speak to them or signal that they should use the drive-up window. It has been working, and no customers have gotten upset over our new routine.”

Assistant branch manager Mandy Crain, also maintaining her social distance.

The branch has also marked the floors with tape six feet from the teller line, the banker desks, and the entry to the safe-deposit box room. Dawn notes they’ve seen higher than usual traffic from customers accessing their safe-deposit boxes. “If someone wants access to their safe-deposit box, we bring their signature entry card to our lobby kiosk so they can sign their card,” she says. “We ask them to wait while we unlock their box with our master key, and then they can proceed to enter the room, unlock and take their box out, and bring it to the viewing room while maintaining our social distancing.”

On the teller line, employees have been using hand sanitizer and Lysol wipes and spray after every transaction, and have also been wiping down buttons in the drive-up lanes and on the ATMs.

Dawn says a number of customers have come in to stock up on cash; the bankers have made sure they realize that cash can carry germs. On the flip side, some business customers — such as restaurants offering takeout and delivery — have made a point of accepting only credit or debit cards (over the phone or online) as payment for the time being. “This is our new normal!” she says. “All we can do is keep our customers informed.” •••

FDIC warns scammers may use virus as opportunity

An important warning from the FDIC: Scammers are taking advantage of the COVID-19 pandemic to commit fraud by posing as representatives of the agency.

An important warning from the FDIC: Scammers are taking advantage of the COVID-19 pandemic to commit fraud by posing as representatives of the agency.

“During these unprecedented times consumers may receive false information regarding the security of their deposits or their ability to access cash,” the FDIC announced in a press release last week. “The FDIC does not send unsolicited correspondence asking for money or sensitive personal information. The agency will never contact people asking for personal details, such as bank account information, credit and debit card numbers, Social Security numbers, or passwords.”

The press release adds: “Consumers may also be contacted by persons who claim to be employed by an agency, bank, or another entity. These scams may involve a variety of communication channels, including emails, phone calls, letters, text messages, faxes, and social media. Scammers might also ask for personal information such as bank account numbers, Social Security numbers, dates of birth, and other details that can be used to commit fraud or sell a person’s identity. Consumers should not provide this information.”

Be aware of these scams in case a customer gets in touch with questions about their FDIC-protected accounts. The agency reminds us that FDIC-insured bank accounts remain the safest place for consumers to keep their money — since its founding in 1933, “no depositor has ever lost a penny of FDIC-insured funds.” Customers who believe they might have been contacted by a scammer can contact the FDIC at 1-877-ASK-FDIC (1-877-275-3342). Additional resources are available at the link to the press release. •••

Seminars, Shredding Day canceled due to COVID-19

North Shore Bank has canceled a number of public events in light of the COVID-19 pandemic and need for social distancing. We have canceled our monthly Path to Wealth seminars for March, April, and May. (The seminars scheduled for June through November remain on the calendar for now.)

We have also canceled our annual Community Shredding Day on May 2, and will in fact discontinue the event going forward, even once the COVID-19 emergency has passed. In a press release, the bank explains: “While Community Shredding Day has been a great resource to the community for the past 13 years, we feel as though there are now safer and more secure online resources that are widely available that can be utilized by our customers rather than paper documents.”

The press release does note that “select North Shore Bank locations may offer shredding resources during various events.” You can read more about the decision in the press release. •••

Seymour Savings is ready to color!

Looking for something to keep the kids occupied and promote the Bank of You? We have 11 pages of our very own Seymour Savings ready to print out and color.

Looking for something to keep the kids occupied and promote the Bank of You? We have 11 pages of our very own Seymour Savings ready to print out and color.

Options abound, from Train Conductor Seymour to Snorkeling Seymour. Have fun! •••

Printed a few for my colored pencils!

Adults color too!