On Facebook, the bank has been sharing tools and tips for managing personal finances. Here are a couple good examples of what the bank has to offer.

On Facebook, the bank has been sharing tools and tips for managing personal finances. Here are a couple good examples of what the bank has to offer.

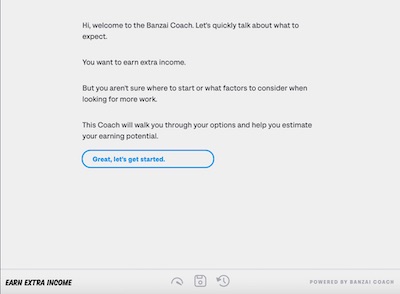

In our website’s Learning Center, you’ll find our Financial Wellness Portal, where an interactive coach can help users figure out ways to earn additional income. The coach walks users through options such as freelance work, temping, starting a small business, or taking gig-economy jobs (like driving for Uber). If you have customers, friends, or family who could benefit from this free tool, share the link!

We also posted about the “50/30/20 rule,” a simple budgeting guideline that says 50 percent of income should go toward needs, 30 percent should be spent on wants, and 20 percent should be put into long-term savings. Check out the portal for more information on the rule, including a 50/30/20 calculator that breaks down monthly after-tax income into the relevant proportions. And see everything available in our Personal Banking Learning Center here! (Note: You may need Chrome or another browser that isn’t Internet Explorer to open these links.)