Know anybody whose credit score could use a boost? A North Shore Bank Credit Builder Loan can be a great way to help make that happen. Here’s how it works:

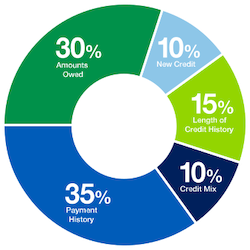

Payment history is the largest factor in establishing good credit.

Once a borrower is approved for a Credit Builder Loan between $1,000 and $4,000, those funds are placed in a certificate of deposit account — the borrower does not get to use the money. The borrower then makes monthly payments for 12 or 24 months. When the amount is paid in full, the borrower then has access to the funds in the CD account, plus whatever interest has accrued.

Making the monthly payments on time shows credit bureaus that the borrower can manage debt responsibly. And when the Credit Builder Loan is paid off, the borrower now has money in savings and most likely a higher credit score. (Most borrowers will see a boost, but it also depends on their other financial activities during the loan period.)

Credit Builder Loans are perfect for students and others with a limited credit history, or for borrowers who want to improve their credit scores. Let your family, friends, and customers know about this great option. You can find more information on the bank website, and download handouts to print out through Ask Seymour.