An old TYME machine.

There’s always something new and exciting happening in payments, especially at our company. Credit and debit cards, ATMs, and electronic funds transfers became part of the banking landscape in the 1960s, ’70s, and ’80s, and their use exploded over the decades that followed, getting a huge boost from internet technology around the turn of the millennium. As this Timeline of Payments Initiatives shows, North Shore Bank has always been a leader in the payments space — giving us a well-earned reputation as a beta tester and early adopter of payment technologies.

1976

In December 1976, North Shore Bank joins the Wisconsin Automated Clearing House Association, founded in March. Pioneers from the get-go, we are the first financial institution in Wisconsin to join the TYME and Cash Plus networks, and the first savings and loan association in the country to issue Master Charge cards (the predecessor to Mastercard).

TYME — which stood for “Take Your Money Everywhere” — was an ATM network founded in Milwaukee in 1975. Consisting only of Wisconsin banks at first, it later expanded into other parts of the country. The network’s iconic machines were known colloquially as “TYME machines” throughout the state. (They disappeared after TYME merged with the Pulse network in 2002, but were brought back last year as part of a promotion by another financial institution.) Also launched in 1975, Cash Plus was a similar network, with about 40 terminals in retail stores, which customers of participating S&Ls could use to make cash withdrawals and deposits.

2003

The Check Clearing for the 21st Century Act — known as Check 21 — is signed into law in October 2003 and will take effect one year later. It allows banks that receive paper checks to create digital versions of those checks and process them electronically. By eliminating costs associated with handling, transporting, and storing physical checks, Check 21 will improve the banking experience for both the industry and our customers.

2004

North Shore Bank creates a Treasury department to handle new payment solutions for our business clients, activities including ACH origination, payroll cards, and wire transfers.

An early version of our Platinum debit card.

2005

We launch our Platinum debit card, which offers additional benefits to users — and will grow to record usage volume in the years to come. We also launch our first lockbox services, allowing customers to make and collect payments.

2006

For the 2006 event, we work with organizers and our third-party partner to let North Shore Bank cardholders use ATMs at Summerfest free of charge. We also introduce our HSA debit card, which customers can use as a payment vehicle from their Health Savings Accounts.

2007

The launch of our REWARDS program will prove to be a huge success, with almost 40 percent of our overall card base participating in it. Debit card activation programs begin in 2007, providing incentives tied to local merchants, and customers respond by increasing their usage of their North Shore Bank debit cards. That success continues today, with new activation campaigns introduced regularly.

Our partnership with Marcus Theatres proved to be very successful at incentivizing customers to use their North Shore Bank debit cards.

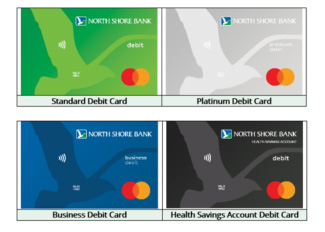

Early versions of our Business debit cards.

2008

North Shore Bank launches its Business debit card. We are also an early adopter of Instant Issue, which lets us issue debit cards to customers from our central location at Corporate. This allows customers to receive their debit cards in half the previous time. We can also accommodate special requests allowing a customer to pick up their card within minutes of ordering it.

2009

We add surcharge-free MoneyPass to our family of ATM networks, meaning North Shore Bank customers pay no fees when using ATMs that are part of MoneyPass.

2010

2010 marks the launch of our first ever business-to-business exclusive initiative, with Mastercard and Chili’s. Card usage hits record highs — it’s a fun promotion and a successful one.

This year is also when the Durbin Amendment becomes federal law, as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act. Although this law — which limits the fees a debit-card issuer may impose on a merchant — applies only to financial institutions with $10 billion or more in assets, smaller institutions will feel its negative impact as well.

2012

North Shore Bank begins giving our customers access to person-to-person payment service Popmoney. We also deploy our first imaged (envelope-free) ATM.

2014

North Shore Bank is the first Wisconsin bank to offer Mastercard’s Masterpass digital wallet, which allows customers to securely store their NSB debit card and shipping information in the cloud, speeding up online purchases.

We also launch the Easy Pay merchant-funded rewards program for our Business debit card, and continue to offer cash credits automatically on business checking accounts.

2015

We perform a major refresh on our Treasury management payment solutions, including ACH origination, wires, small business bill pay, and much more. Rollout of credit and debit cards with EMV chips begins and will be completed in 2016, helping to slow down fraud. We launch Biller Advantage (aka Bill Matrix Next / Pay Your Loan) and Biller Direct, making it much easier to add billers when customers register them for Bill Pay. Finally, North Shore Bank is also among the first 100 financial institutions to launch Apple Pay.

2016

The first phase of our same-day ACH service goes live. We also launch debit card alerts.

2018

Our launches this year include Customer Preferences (i.e., debit card controls) and more digital wallets: Android Pay and Samsung Pay.

2019

We launch Secure Remote Commerce, which provides our cardholders with a consistent digital commerce experience while keeping their North Shore Bank debit card top of wallet.

Our current contactless cards.

2021

Our contactless cards launch, and we start giving customers access to the instant payment service Zelle.

2022

We begin our conversion to Fiserv’s EPOC system, fully integrating many different services and making life easier for bank employees. EPOC offers numerous new tools to our cardholders.