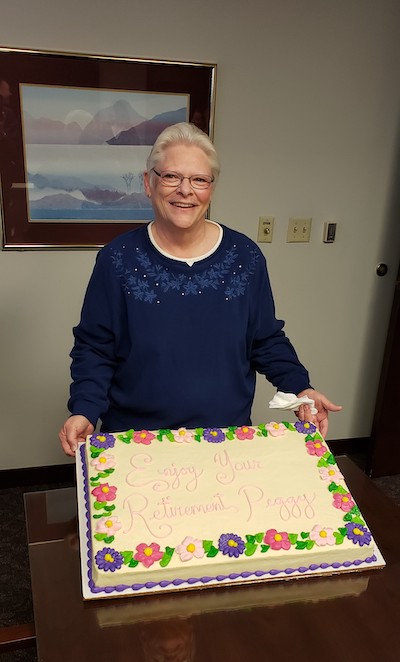

Peggy Winchell retires

Peggy with her cake.

Mortgage loan underwriting team leader Peggy Winchell retired on January 3. Her colleagues celebrated her 17-year career at North Shore Bank with cake and camaraderie. “We will miss her dearly!” said VP consumer and mortgage underwriting manager Gina Bontempo. •••

Support the North Shore Climbers in Fight for Air climb

Help the North Shore Climbers raise money for clean air and healthy lungs! They’ll hit the steps of Milwaukee’s U.S. Bank Center on March 7 for the American Lung Association’s Fight for Air Climb, and your donation can help.

Help the North Shore Climbers raise money for clean air and healthy lungs! They’ll hit the steps of Milwaukee’s U.S. Bank Center on March 7 for the American Lung Association’s Fight for Air Climb, and your donation can help.

Current team members include captain Molly Schissler, SVP human resources and compliance; VP business banking Mike Cornell; deposit operations supervisor Kristin Hoch; and assistant controller Ann Marie Krecak.

To donate or to join the team, visit http://action.lung.org/goto/NorthShoreClimbers20. •••

Here’s how the new SECURE Act affects our customers

Last month, Congress passed the Setting Every Community Up for Retirement Enhancement Act. This bipartisan legislation will affect Americans’ retirement savings plans, so it’s important for you to know a little bit about the SECURE Act, in case our customers have any questions. Here are a few key takeaways:

Last month, Congress passed the Setting Every Community Up for Retirement Enhancement Act. This bipartisan legislation will affect Americans’ retirement savings plans, so it’s important for you to know a little bit about the SECURE Act, in case our customers have any questions. Here are a few key takeaways:

There is no longer an age limit to contribute to a traditional IRA. Before the SECURE Act passed, you could only contribute to an IRA until you turned 70½ years old. Now, starting with contributions made from January 1, 2020, onward, you can contribute to an IRA no matter how old you are.

Required minimum distributions don’t start until age 72. Previously, IRA owners had to take RMDs from their IRAs starting at age 70½. But if you turn 70½ after January 1, 2020, you won’t have to take them until you are 72. (If you turned 70½ before January 1, this change does not affect you — you still have to take your distributions as previously required.)

Distributions from inherited IRAs must typically be taken within a 10-year window. If an IRA owner dies after December 31, 2019, in many cases the funds from the account will need to be distributed to whoever inherited it within 10 years. There are exceptions, however, for spouses who inherit the IRA when a partner dies; disabled and chronically ill individuals; inheritors who are not more than 10 years younger than the IRA owner; and children who inherit an IRA but have not yet reached the age of majority.

You can now draw from an IRA before retirement age to help with birth or adoption. IRA owners can take up to $5,000 penalty-free from their accounts to help cover the costs of giving birth or adopting a child after January 1, 2020. (They will still pay regular income tax on the distribution.)

Section 529 plans have been expanded to help with education costs. Funds can now be withdrawn from 529 accounts to cover costs associated with registered apprenticeships and qualified student loan repayments, including repayments for siblings.

Small businesses are being encouraged to offer retirement plans. A number of changes make it easier for small businesses to offer retirement plan benefits to employees, including long-term part-time employees.

If you have questions about the SECURE Act and its impact on IRAs or other retirement savings plans, talk to your local branch manager. •••

Brookfield Capitol gets new manager

New Brookfield Capitol branch manager Rilley Franz is from Gary, Indiana, and previously worked as a center manager for FedEx Office. He talked to Shorelines about what brought him to North Shore Bank.

New Brookfield Capitol branch manager Rilley Franz is from Gary, Indiana, and previously worked as a center manager for FedEx Office. He talked to Shorelines about what brought him to North Shore Bank.

How did you get into banking?

Once I knew I was leaving FedEx Office, I was speaking with my district manager and he recommended that I look into the financial field, because I was doing the financial auditing for our district and seemed to really enjoy it. That caused me to open up my job search more and start looking at banking.

How would you describe your management style?

My management style is to lead by example and develop my team so that they can be as self-sufficient as possible and move up if that is something that they are interested in.

What might you be doing if you weren’t in banking?

Most of my working experience is in management in logistics and printing, so I would be working in one of those fields.

And what’s one fun, interesting, or goofy fact about you?

I played semipro basketball for three years, but now I spend my time with my wife and our 18-year-old pit bull, Eve. Our home time is spent playing tug-of-war with stuffed animals and going on car rides. •••

Service Anniversaries for January 2020

The following employees celebrate a milestone anniversary with North Shore Bank this month.

5 years

Steven Luebke, Senior Mortgage Lender

Leave a comment to congratulate them!

New Hires for January 16

It’s always exciting to add new members to our team. Here are some of the fresh faces at North Shore Bank.

Union Grove teller Donna Filler is from Union Grove and previously worked in customer service. She and her family enjoy spending time in the outdoors and camping all over Wisconsin. “Our favorite spot is Lake Arrowhead in Montello,” she says. “It is very family-friendly, and there are always activities going on for kids and the adults.”

Union Grove teller Donna Filler is from Union Grove and previously worked in customer service. She and her family enjoy spending time in the outdoors and camping all over Wisconsin. “Our favorite spot is Lake Arrowhead in Montello,” she says. “It is very family-friendly, and there are always activities going on for kids and the adults.”

Regency teller Judith Hagen is from Kenosha and previously worked for Pandora. She and her husband, a Navy man, have lived many places, and she knows how to cook dishes from all around the world. “When we lived in Guam, I learned how to make a dish called pancit, a Filipino noodle dish,” Judith says. “And I do a killer egg roll also.” •••

Regency teller Judith Hagen is from Kenosha and previously worked for Pandora. She and her husband, a Navy man, have lived many places, and she knows how to cook dishes from all around the world. “When we lived in Guam, I learned how to make a dish called pancit, a Filipino noodle dish,” Judith says. “And I do a killer egg roll also.” •••