This picture of the then-new drive-up canopy at Shorewood, from our 1984 annual report, features Sue Doyle’s blue Dodge Colt. “I laughed when I saw it,” she says. “I don’t recall staging this photo at all.”

A century of history naturally means we’ve had to grow to meet our customers’ changing needs. One of the more notable examples of this is how we adapted to demand for drive-up banking solutions. Former VP and branch administration coordinator Darrel Eisenhardt (who retired in 2018) and head of retail banking SVP Sue Doyle put together the following overview of the evolution of drive-up banking at North Shore.

This ad from 1970 touted a convenient new option for North Shore customers.

North Shore customers first got the opportunity to bank from their cars when we rebuilt our Shorewood location in 1970, using a through-the-wall drawer (a deal drawer) that allowed them to make deposits, withdrawals, and loan payments. Today, only two of our branches still have deal drawers — Pewaukee and Sister Bay — and both of these offices are scheduled for changes to their drive-up areas this year. Pewaukee will shift to offering only video teller and ATM service. Sister Bay will keep the drawer, but will also have a video teller/ATM installed at the branch.

When Congress passed the Depository Institutions Deregulation and Monetary Control Act of 1980, savings and loans were allowed to offer checking accounts. Thousands of North Shore customers opened checking accounts, which meant we needed to expand our servicing capabilities — walk-in and a single lane with a deal drawer were no longer sufficient. Throughout the ’80s and ’90s, the bank invested in expansive drive-up areas with multiple lanes and pneumatic tube technology.

Shorewood was one branch where drive-up customers had been served through a one-lane deal drawer, which operated out of a separate area from the teller line. When the drive-up canopy was built there in 1984, that area was enlarged to accommodate two to three tellers, who served customers across multiple lanes through pneumatic tubes. The night before the drive-up service at Shorewood was opened to customers, branch staff gathered under the canopy and christened the new setup with a bottle of Champagne.

The trailer where Wauwatosa employees worked while the new branch and its drive-up facilities were being built is visible to the left of the building under construction in 1995.

In some cases, as at our Wauwatosa branch, this entailed purchasing the building on the lot next to us, tearing it down (along with our existing branch), and building a new office with multiple drive-up lanes. While construction was under way, our branch employees operated out of a trailer.

In some cases, as at our Wauwatosa branch, this entailed purchasing the building on the lot next to us, tearing it down (along with our existing branch), and building a new office with multiple drive-up lanes. While construction was under way, our branch employees operated out of a trailer.

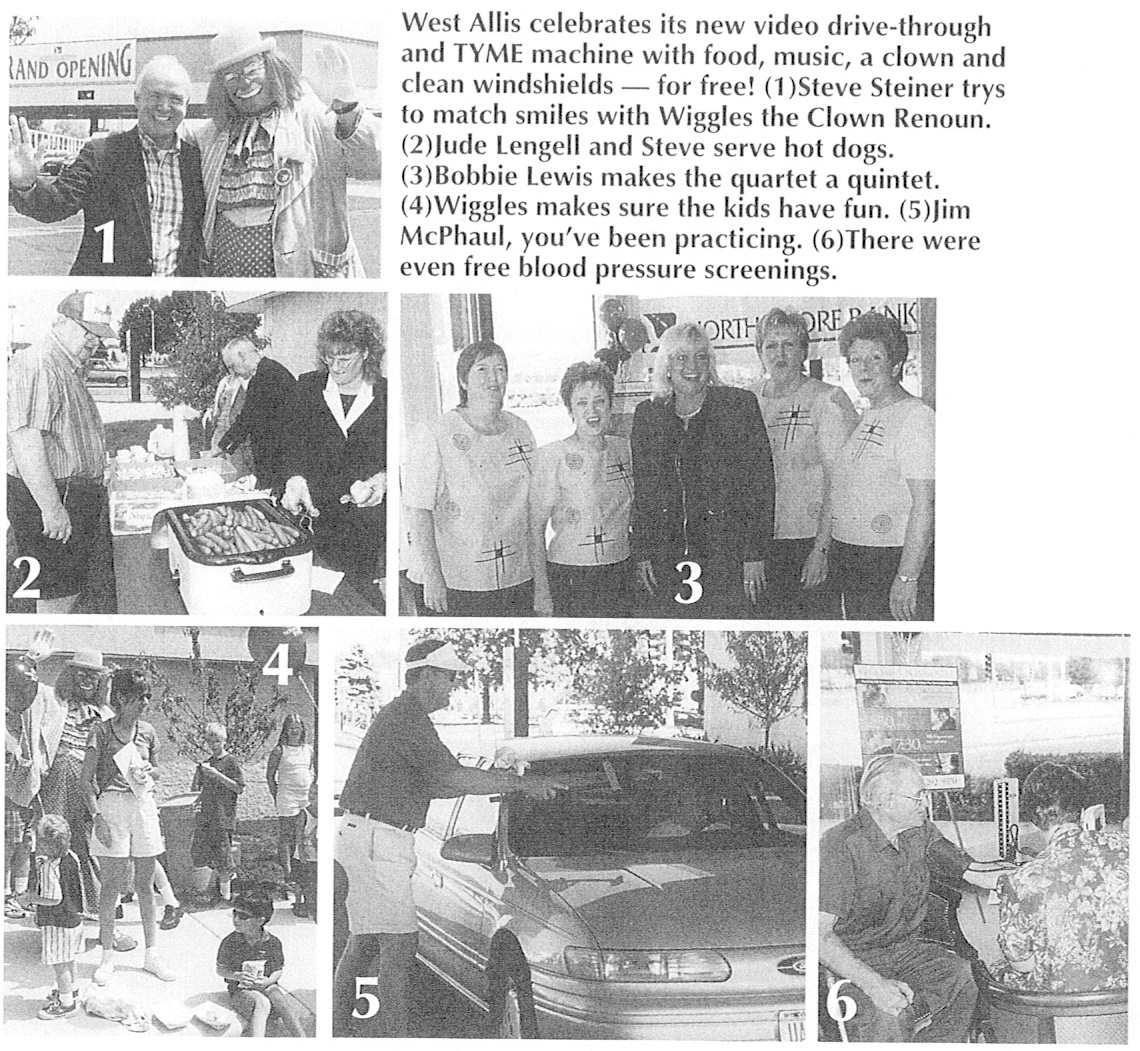

Photos from a 2001 edition of Shorelines document the installation of an upgraded drive-up area at the West Allis branch.

By 2000, electronic banking was becoming more prevalent and customers were increasingly choosing to bank electronically, resulting in a decline in transactions being performed at branches. To use branch labor more efficiently, Remote Teller Systems (RTS units) were installed on teller lines, allowing tellers to handle both lobby and drive-up transactions. Separate drive-up areas quickly became a thing of the past. (Our technology impressed and fascinated a pair of bankers from Ukraine who visited the Northside branch in 2002. Racine’s Journal Times and Herald covered their trip.)

Sue shows off the video teller unit at Howard in this photo from a 2014 Green Bay Press-Gazette report on the new machines.

Customer preference continued to migrate from banking in person at branches to electronic transactions. Once again, to meet customer needs and expand our service to seven days a week, the bank invested in video teller technology. In 2013, North Shore Bank became the first in the state to deploy this technology and the first in the county to have a video teller unit be dual-purpose ATM and video teller. Ten years later, by the end of 2023, we will have over 30 locations with video teller/ATM service in our drive-ups.