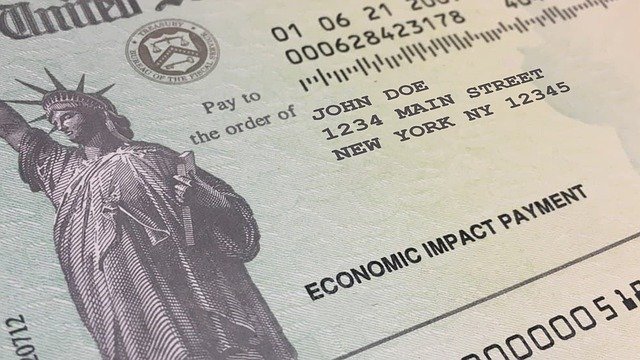

While the COVID-19 pandemic has obviously been challenging for everyone, it had an especially large impact on a couple of North Shore Bank teams. Our ACH and Checking Services teams handled many issues relating to the three stimulus payments disbursed by the federal government.

“Each stimulus was a little bit of a different scenario,” said vice president deposit operations Jude Lengell. Americans received the first payment last spring, another at the beginning of 2021, and a third payment this spring. “But in all cases, several teams worked really hard to prepare and to make it seamless and easy for our customers.”

Because the payments were going to millions of households, using previous years’ tax filings to determine how and where they should be sent, it was inevitable that some of the electronic deposits would be rejected because of outdated or inaccurate information. Some payments were directed to accounts that had been closed, for instance. For one set of payments, the IRS had erroneously identified several of the deposit accounts as savings when they were really checking.

“ACH and Checking had a large number of rejected deposits that we could have sent back to the IRS,” Jude said. But instead of simply rejecting those payments outright, the teams flagged issues they could address themselves and fixed them.

“We’d find the new account number or correct information and apply it. All of that was very manual,” Jude said.

“The three main direct-deposit days were one of the biggest challenges,” senior ACH specialist Nancy Adamski said. “The first wave had over 700 rejects to either post or return and took us two days to complete. The second round had even more — over 800. The most recent was a mere 300. A piece of cake! Now we feel very prepared for Round 4, or whatever comes our way.”

Jude is also quick to note that other departments were essential to the process. The Customer Support Center and Branch Administration had to ensure their employees could answer questions about the stimulus payments, and Marketing ensured the bank’s website provided up-to-date information for customers searching for answers online. Systems data analyst Beth Williams provided the much-needed data for several of the processes and reporting of these deposits.

Nancy and senior ACH specialist Lindsey Schneider took the brunt of the temporary heavy workloads. Checking services manager Erica Johnson and the rest of the checking team did their best to make sure those two could focus on the stimulus payments, by taking on other more routine duties and questions.

“It was truly SOARing and going above and beyond by the Checking and ACH teams to ensure the customers got the payments they were expecting,” VP security/payments manager Lyneen Fischer said, adding that she thought many customers learned to appreciate the safety and simplicity of direct deposits, and the importance of keeping their information up to date.

“We wanted to make sure people got their payments as soon as possible,” Jude said. “We did what we always do at North Shore Bank, which is trying to do the best by our customers.”