North Shore Bank’s CrimeBusters for March 2023 are: Wauwatosa teller supervisor Tyreese Hernandez, senior checking services rep Renee Machado, and New Berlin teller Chris Moyses.

North Shore Bank’s CrimeBusters for March 2023 are: Wauwatosa teller supervisor Tyreese Hernandez, senior checking services rep Renee Machado, and New Berlin teller Chris Moyses.

Security Saves: This Month’s Highlights

An older customer came in wanting to wire $9,000 for an investment. The teller knew this was an unusual type of transaction for this customer. She asked him some more questions about the wire and saw that he did not seem confident about his answers. The teller was able to get the customer into an office and called Security. Security learned that the customer had received an email from “Microsoft” and had been instructed to wire $9,000 to get his PC unlocked.

Security says: Most of us use our cell phones for just about everything now, from taking pictures and ordering groceries to doing our day-to-day banking. And while it is convenient to have so much power in the palm of our hand, it also allows for millions of people to be targeted by cyber-attacks. The common attacks we see involve smishing, vishing, and spoofing.

Smishing is when a scammer uses SMS/text messages to get the target’s personal or financial information, often posing as the target’s bank or a company like Amazon.

Smishing is when a scammer uses SMS/text messages to get the target’s personal or financial information, often posing as the target’s bank or a company like Amazon.

Vishing (voice or VoIP phishing) is a type of cyber-attack that uses voice and telephony technologies to trick targets into revealing sensitive data.

Spoofing allows scammers to falsify their caller ID information, to match legitimate phone numbers for just about anyone. Vishing and spoofing combined have led to millions of dollars in losses for consumers.

But how do you know if a text or call is really from a scammer? Great question! Here are some tips:

- When in doubt, call the phone number on the back of your credit or debit card (if the text or call claims to be from the issuing bank) or the customer service number on the company’s website. Never call the number from the email or text message!

- If you receive a text message asking to verify a debit card transaction, look at your online banking. Don’t respond to any messages or open any links. Often, this is a scammer waiting for you to respond “No” so they can call and pose as the “fraud department.”

- Scammers sometimes call the target saying they are from the target’s bank or another institution, and that there is a problem with the target’s account or credit card. The false alert may also arrive by SMS initially, asking the target to call a number to resolve the issue.

- If a text message says “Do not share with anyone” or “Enter code in your device only,” follow those instructions! Scammers will try to deceive you by saying they need that code to shut down your debit card. But the code could be for a digital wallet activation, online banking access, or authorization for a purchase. Never give out those codes.

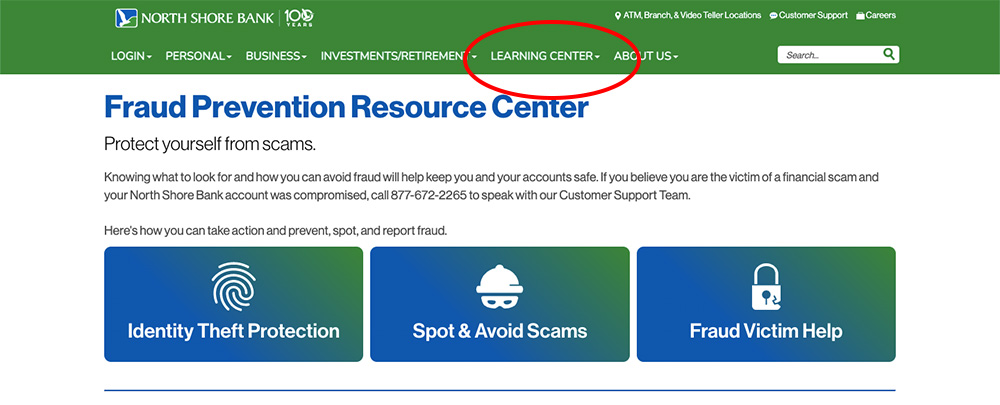

The Learning Center on the North Shore Bank website is a great resource where customers can find up-to-date information on scams, as well as guidance on what to do if they fall for a scam. Make sure your customers know about it.

As always, trust your instincts! If something feels off, contact Security immediately for guidance on how to proceed.

Started by former security officer Peggy Theisen in 2013, the CrimeBuster Awards recognize bank employees who identify security risks and take action to protect North Shore Bank and our customers.

Great job everyone!