To take our service further, embrace possibility thinking

Possibility thinking: Bank-wide training recently came to a close. North Shore Bank has an outstanding reputation today for high-touch service. As we celebrate our 100th anniversary, exploring what’s possible for our customers and moving to a solution-oriented mindset will give us an upper edge in continuing to deliver exactly that.

Possibility thinking: Bank-wide training recently came to a close. North Shore Bank has an outstanding reputation today for high-touch service. As we celebrate our 100th anniversary, exploring what’s possible for our customers and moving to a solution-oriented mindset will give us an upper edge in continuing to deliver exactly that.

Now it’s time to build on what we learned, together! To kick things off, managers will be asked to incorporate possibility thinking concepts into their weekly team huddles starting on Monday, June 5. Stay tuned for more details via Seymour Says and the What’s New section of Ask Seymour. —Milene Below, Training and Internal Communications Manager •••

Municipal Retirement department makes bank unique

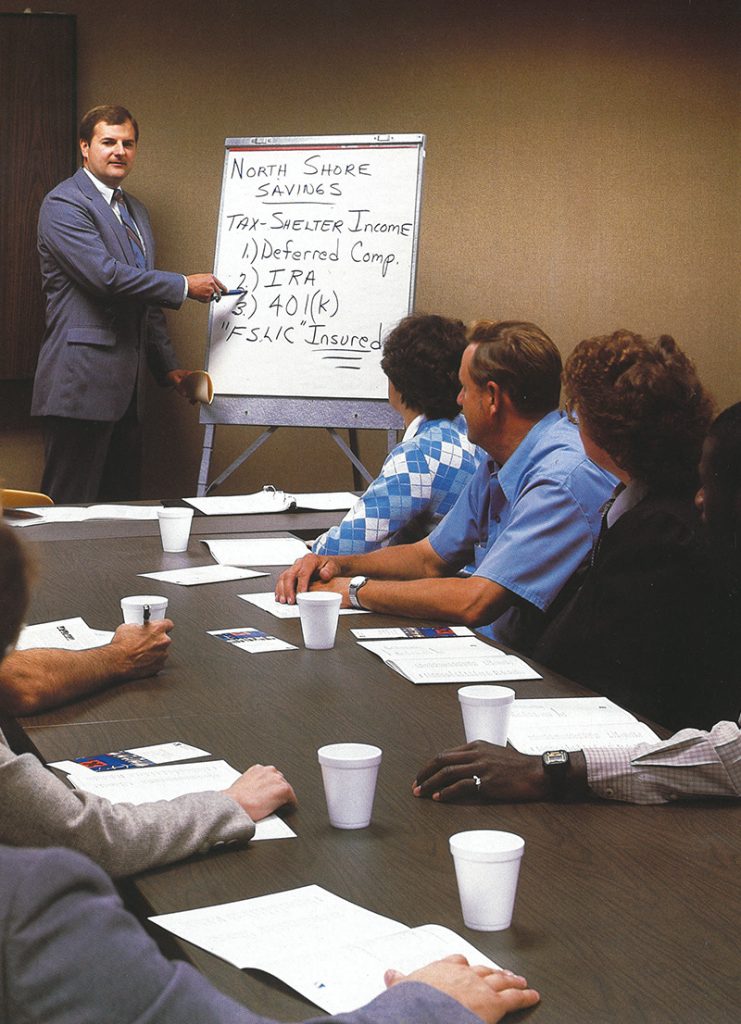

Former Municipal Retirement Program Services head Dennis Christoffel leading a presentation in 1984.

Lots of things make North Shore Bank special, but the Municipal Retirement Program Services department makes us unique. Not only are we the only Wisconsin-based business offering 457(b) deferred compensation plans for state and local government employees, we’re also the only bank in the United States to offer such a plan at all. Here’s the story behind a very interesting part of North Shore Bank.

Furry, feathered, funny visitors entertain employees

Daisy getting her treat from Christine.

North Shore Bank employees have enjoyed visits from furry, feathered, and funny friends this month!

North Shore Bank employees have enjoyed visits from furry, feathered, and funny friends this month!

Daisy and her human, Molly, come into the New Berlin branch every week to make a business deposit. On this trip, the pooch got a withdrawal too — in the form of a treat from teller Christine Moyses. After that, branch manager Sara Swosinski says, “Daisy was all smiles!”

Wanting to hear more about “SOAR Together.”

Seymour might have spread the word about this month’s terrific checking promotion, prompting this rock pigeon to stop by the Kenosha Main branch, says universal banker Noemi Faz. She jokes, “Wanted to make sure not to miss out on that gift card!”

Grogu — formerly known as Baby Yoda — on Amy’s desk.

And to celebrate Star Wars Day on May 4, training specialist Amy Ruffalo brought in everybody’s favorite green Force user, Grogu. “I would definitely describe myself as a big Star Wars fan!” Amy says. “I was super excited to have a reason to bring my foundling to class with me.” •••

Bitcoin scams rely on victim’s lack of knowledge

North Shore Bank’s CrimeBusters for April 2023 are: Westgate personal banker Jeshon Alexander, Northside teller supervisor Kelly Elliott, checking services manager Erica Johnson, Pulaski area manager Katie Longsine, senior checking services rep Renee Machado, and Sister Bay teller Debbie Proto-Maring.

North Shore Bank’s CrimeBusters for April 2023 are: Westgate personal banker Jeshon Alexander, Northside teller supervisor Kelly Elliott, checking services manager Erica Johnson, Pulaski area manager Katie Longsine, senior checking services rep Renee Machado, and Sister Bay teller Debbie Proto-Maring.

Security Saves: This Month’s Highlights

A customer came into a branch wanting to send a wire for $30,000, based on a tip he got from a “friend.” The wire didn’t make sense to the banker, and the customer could not provide any details when asked. When the banker told the customer Security would need to review the wire before it could be sent, he became upset and left the branch.

Later that day, the customer came back and said he’d gotten a message from Microsoft, via a pop-up window on his PC. “Microsoft” told him a $15,000 freeze had been placed on his North Shore Bank account. The fraudster then connected him with a “North Shore Bank representative” who said they were investigating the freeze, but that to protect the rest of his money, the customer should wire his funds to another bank that was protected by the FDIC. The fraudsters had even given the customer a script of what to tell our bankers when we asked about the wire.

Security says: Scammers often use wire transfers because they’re an easy way to transmit a large amount of money quickly. It’s hard to say no to a customer — whenever possible, we want to find ways to say yes! — but this is a case where saying no prevented the customer from losing $30,000.

Sometimes when a wire is denied, the fraudster then urges the customer to withdraw cash. Why? Because of another growing trend: Bitcoin ATM deposits. These machines accept cash and exchange it for Bitcoin cryptocurrency, which is entirely digital.

Sometimes when a wire is denied, the fraudster then urges the customer to withdraw cash. Why? Because of another growing trend: Bitcoin ATM deposits. These machines accept cash and exchange it for Bitcoin cryptocurrency, which is entirely digital.

Bitcoin ATM scams can involve anything from a romance scam to a PC hack to the scammer posing as law enforcement or a government official. The scammer sends the victim a QR code and tells them to use it after depositing the cash in the ATM. But the QR code tells the ATM to deposit the money in the scammer’s digital wallet. It’s that easy — the scam preys on the victim’s lack of knowledge about how the technology works. But can’t the transaction be stopped or reversed? Unfortunately, no. Because of the decentralized nature of cryptocurrency, once the deposit is confirmed, the money is essentially irretrievable.

Not all wire transfers or Bitcoin purchases are scams, of course. So how do we protect our customers? The most important thing is to know your customer. If a customer comes in to withdraw or wire a large amount of money:

- Review their transaction history to see if this is typical for them.

- Make conversation and ask questions. Do they seem nervous or anxious?

- Has the money been transferred from savings or a line of credit? If so, that may be an indication the customer is the victim of a PC hack or another type of scam.

- Talk about scams that are going on and explain that’s why you’re asking questions. We want to make sure we protect our customers and the money they’ve worked so hard for.

Check out these articles about the rise in crypto scams, how they can happen, and how to protect yourself and your customers:

AARP: What you need to know about cryptocurrency scams

CT Insider: CT man duped into putting his life savings in a Bitcoin ATM

As always, trust your instincts! If something feels off, contact Security immediately for guidance on how to proceed.

Started by former security officer Peggy Theisen in 2013, the CrimeBuster Awards recognize bank employees who identify security risks and take action to protect North Shore Bank and our customers. •••

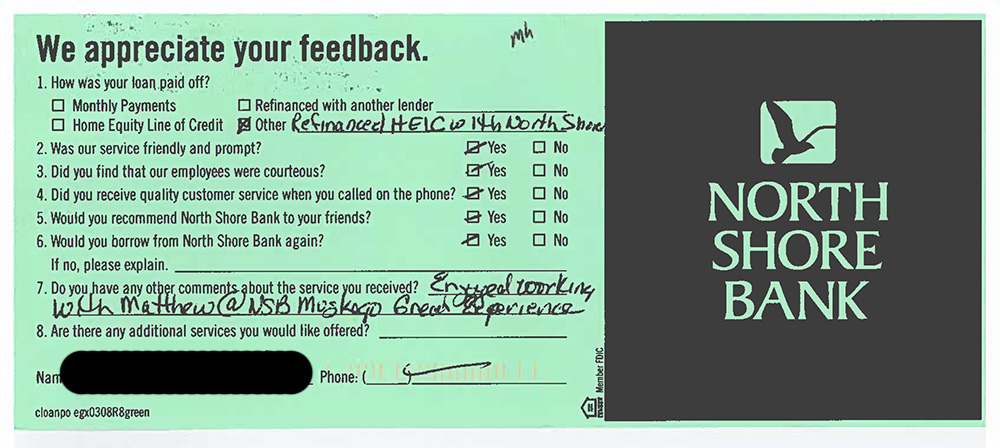

Customer happy with Cieslak

This customer had nothing but praise for Muskego personal banker Matthew Cieslak after he helped her refinance a HELOC. “Great experience,” she wrote. •••

Service Anniversaries for May 2023

Earlier this month, the underwriting team celebrated Cathy Swanson’s 10th anniversary with the bank, which took place in April.

The following employees celebrate a milestone anniversary with North Shore Bank this month.

20 years

Kim Dane, Universal Banker, Forest Home

15 years

Georgia Phillips, Senior Consumer Loan Specialist

Jamie Sperk, Lending Quality Control/Residential Processing Manager

5 years

Dan Fregoso, Systems Analyst

Bret Gagliano, Teller, Forest Home

Leave a comment to congratulate them!

New Hires for May 18

It’s always exciting to add new members to our team. Here are some of the fresh faces at North Shore Bank.

Marketing data analyst Jordan Gundrum is from West Bend and previously worked as a data analyst at HealthEquity. He has also worked as a carpenter and has a small woodworking business, creating custom furniture, cabinets, and home goods. “I’ve been doing it for probably 15 years and started my little business about four years ago. My dad did a lot of woodworking, so I grew up playing around in his workshop,” he says. •••

Marketing data analyst Jordan Gundrum is from West Bend and previously worked as a data analyst at HealthEquity. He has also worked as a carpenter and has a small woodworking business, creating custom furniture, cabinets, and home goods. “I’ve been doing it for probably 15 years and started my little business about four years ago. My dad did a lot of woodworking, so I grew up playing around in his workshop,” he says. •••

Path to Wealth covers managing bank accounts

What’s going on with you? If you or someone in your family has a special event — a concert, show, sporting or charity event, or another important moment — send the details to shorelines@northshorebank.com. We’ll include information about select events to let your colleagues know about all the cool stuff happening with the North Shore Bank team.

The Springfield Park neighborhood in Appleton is holding a Community Garage Sale the mornings of Friday and Saturday, May 19 and 20. The whole neighborhood is invited to participate in this event, which is being organized by North Shore Bank mortgage loan originator Michele Cope and Selina Leitner of Keller Williams Fox Cities. They will provide free signs and treats to every house hosting a garage or yard sale. And if you don’t live in Springfield Park, you should come out to shop! More info here.

The Springfield Park neighborhood in Appleton is holding a Community Garage Sale the mornings of Friday and Saturday, May 19 and 20. The whole neighborhood is invited to participate in this event, which is being organized by North Shore Bank mortgage loan originator Michele Cope and Selina Leitner of Keller Williams Fox Cities. They will provide free signs and treats to every house hosting a garage or yard sale. And if you don’t live in Springfield Park, you should come out to shop! More info here.

Looking for more to do? Here are suggestions from the bank’s event calendar:

North Shore Bank is happy to sponsor the Cudahy Police Department’s 2023 K-9 Fundraiser this Saturday, May 20, at South Shore Bowl. Come and enjoy bowling, pizza, and lots of fun! More info here.

The next installment of our Path to Wealth seminar series takes place this Saturday, May 20, at our Jackson Park branch. Area manager Alfredo Martin and community lending manager Miguel Pesqueira will talk about “Managing Your Bank Accounts.” More info here. •••

The next installment of our Path to Wealth seminar series takes place this Saturday, May 20, at our Jackson Park branch. Area manager Alfredo Martin and community lending manager Miguel Pesqueira will talk about “Managing Your Bank Accounts.” More info here. •••