Lots of things make North Shore Bank special, but the Municipal Retirement Program Services department makes us unique. Not only are we the only Wisconsin-based business offering 457(b) deferred compensation plans for state and local government employees, we’re also the only bank in the United States to offer such a plan at all.

Here’s the story behind a very interesting part of North Shore Bank.

Former department head Dennis Christoffel, who retired in 2015, credits both executive chairman Jim McKenna and former North Shore Bank executive John O’Hara for adding 457(b) plans to our offerings. It all started around 1979, when O’Hara — inspired by West Coast bankers he’d met at a conference — got interested in selling retirement plans, traditionally the province of insurance companies.

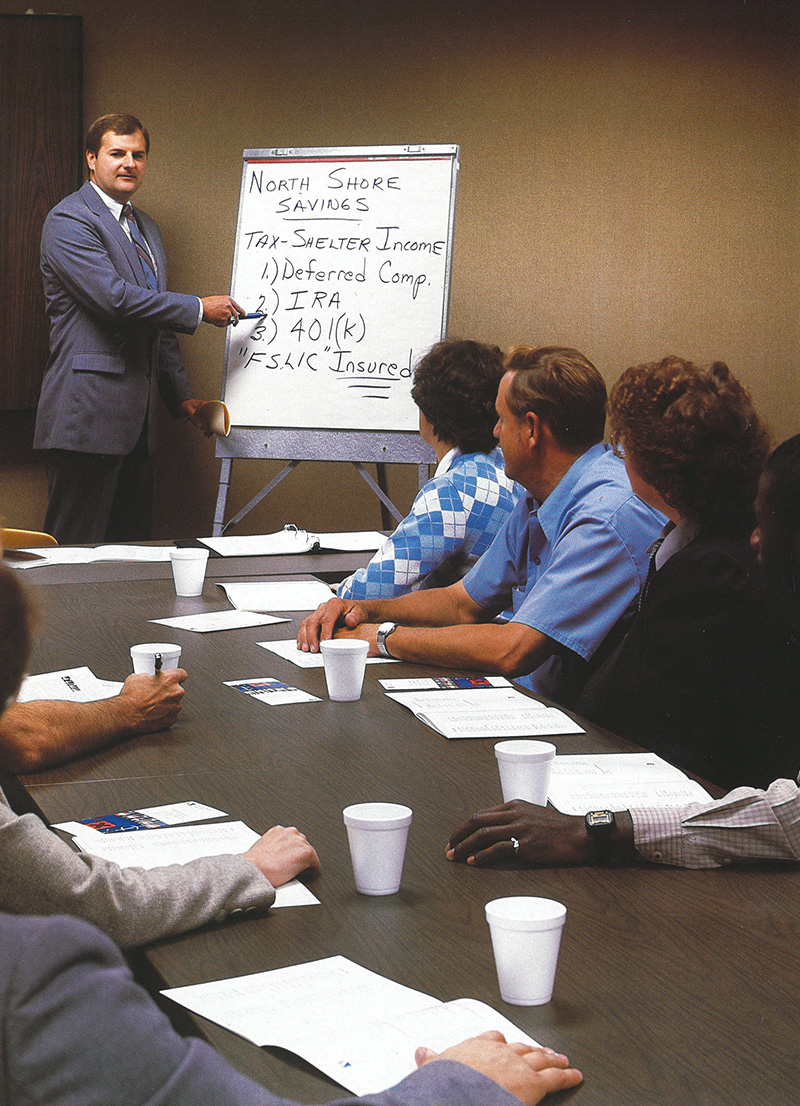

Former retirement services head Dennis Christoffel leads a presentation in 1984.

At the time, Dennis was teaching and working three part-time jobs. He had a master’s degree in administration of education — and no experience in finance, insurance, or retirement programs. But after responding to O’Hara’s ad for the position, he was intrigued.

“Between all my jobs, I was working probably 70 hours a week,” he says. “So I said, you know what? If I take that 70 hours and devote it to this job instead, I can make or break it myself.”

Dennis was pretty much the entire retirement services department. Besides determining how our 457(b) product would work, he was in charge of creating marketing materials and had to go out and sell the plans as well.

Our size was an advantage, he says. The insurance corporations that handled most 457(b) plans were enormous, faceless entities based in other parts of the country. A former public employee himself, Dennis found the idea of a local company managing his retirement plan appealing, and he suspected others would too.

“I always thought, Wouldn’t it be nice if I could have my retirement plan in the little brick bank downtown? I like to deal with people face to face,” he says.

Another advantage was that a bank’s 457(b) accounts were individually insured by the FDIC. However, one insurance company’s CEO had a close relationship with the agency’s chairman at the time. Fearing competition, the CEO tried to convince his friend that banks shouldn’t be allowed to offer the plans.

That led to Dennis traveling to Washington, D.C. to give a 15-minute speech at an FDIC hearing.

“It was kinda cool,” he says. “The bottom line was: The FDIC adhered to what our attorneys had felt was correct, and agreed we should be able to compete in that marketplace.” 02732

The insurance company CEO’s worries might have been overblown. Deferred-comp plans never did take off as a banking product. “Most banks were not mutual savings banks like North Shore,” Dennis says. “They were stock banks, and the people running them needed to report profits to shareholders.” It took time for our Municipal Retirement Program Services department to become profitable. Other banks didn’t want to spend that time.

Becky Reinhardt took over the department from Dennis after he retired in 2015.

It has also taken a lot of work. As current department head Becky Reinhardt notes, when her team takes on a new client, they have to sell North Shore Bank twice: first to the municipality itself, and then to its employees, who frequently choose among multiple 457(b) offerings when they’re hired.

So after presenting to a county board, Dennis says, he often found himself sitting down at a county worker’s kitchen table. He remembers a firefighter who, with Dennis’s encouragement, used some of his savings after retirement to travel with his wife. When the firefighter died after developing ALS a couple of years later, his widow expressed how grateful they were that they’d taken those trips while they could.

“It was probably the most rewarding thing in the world to be able to offer plans where the people who really needed it understood the benefit,” Dennis says. “You’re helping people live a better life than they thought they could.”

It’s been rewarding for the bank, too, as workers who have 457(b) plans with us open other accounts and take out loans here too.

Because so much of his role centered on relationships, Dennis knew he had to find the right person to lead the department when he himself retired. He had worked with Becky for a number of years at the bank’s Shorewood office, where the department was based at the time.

“I saw it in Becky and in Vikki Dolezal,” he says. (He hired Vikki — now a retirement plans rep — after working with her when she was village clerk in Waterford.) “You know when you talk to them that they really care, they’re really listening to you.”

When Dennis approached Becky about being his successor, he told her he had a list, she says. “He said, ‘You’re the bottom of my list, you’re the top of my list — you’re my list.’”

Since Becky took the reins, the department has added over 60 municipalities as clients, growing from $108 million in 457(b) deposits to over $160 million. The key has been maintaining those strong relationships and that high-touch service.

“We pride ourselves on service, on returning your phone call within 24 hours,” Becky says, noting that the large insurers who are our competition generally take up to five business days. “Our customers have our direct lines, they have our direct emails, and most of them even have our cell numbers.”

It keeps the small department awfully busy. But that’s OK.

“It’s not work,” Becky says. “It’s like visiting friends and helping them. And I absolutely love that.”